BANKING

In 1994, there were many banks and building societies in every high street. Banks offered the a sense of community and connectedness. They provided an opportunity for social contact, financial help and advice.

“high street banks could set aside time so people could engage with a human being”

Connor Campbell from Nerd Wallet

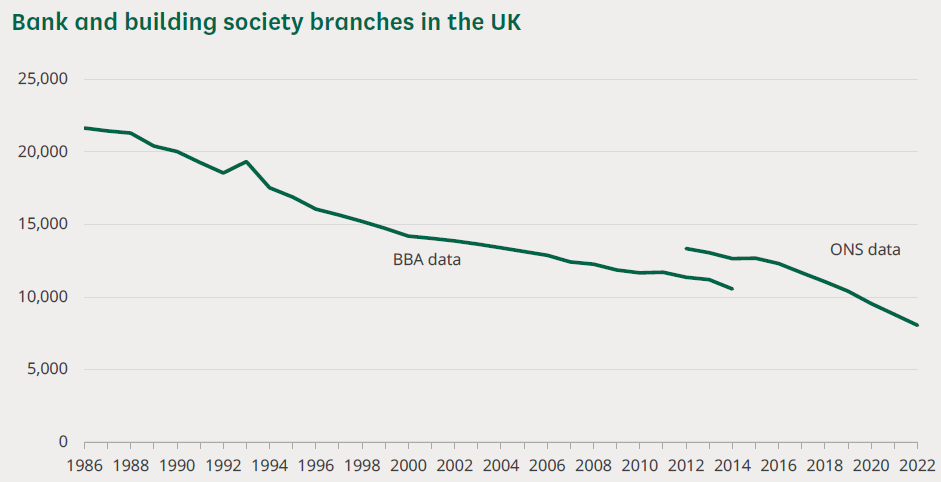

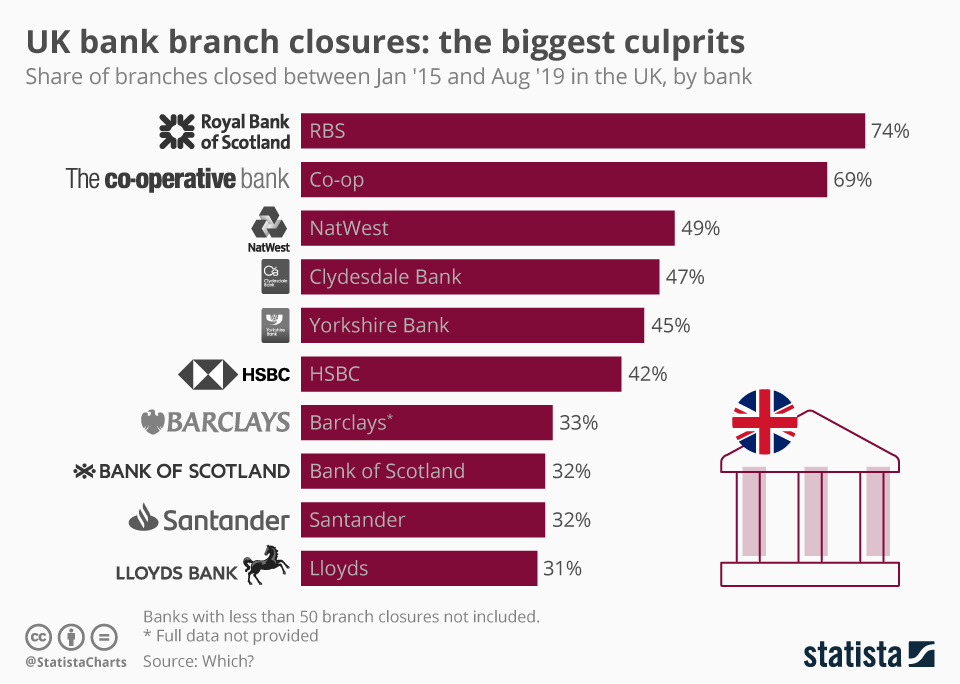

However, since 1994, banks have been disappearing from the high street at a fast rate. This table and this graph shows the rapid closure of banks and building societies.

In 1997 Royal Bank of Scotland became the first British bank to announce an internet banking service. As broadband and e-commerce systems quickly improved, this online banking quickly spread in the early 2000s. Now people could do their finances using telephone banking or online services, rather than visiting a bank.

In 2024, 86% of UK adults use online banking, which is around 46 million people. 53% of UK adults, around 28 million people, use mobile banking. Now 36% of us have a digital-only bank account.

Therefore, banks in high streets were no longer needed. Between 2015 and 2020, the NatWest Group closed 1,086 branches. In January 2021, HSBC closed 82 UK branches in just one month.

Now in the UK, 1500 towns have no bank at all and 840 have just one bank. Wales is the part of the UK that is losing the most banks.

A report by ComRes found that 70% of people think it is important to have their local bank branch close by. They said that even people who are very good at technology need face-to-face support from a proper bank.

Therefore, in 1994, there were banks and building societies in every high street. They offered the opportunity for human contact and face to face financial advice. However, due to the rise in online banking, high street banks are increasingly rare in 2024 and therefore increasing peoples atomisation and detachment from others.